BlackRock, one of the world's largest investment management firms, often finds itself at the center of discussions regarding its influence in global finance. While its operations span across various sectors and demographics, a particular narrative surrounding its "Jewish connections" has gained traction online. This article aims to provide a comprehensive analysis of BlackRock's history, leadership, and the myths surrounding its alleged ties to Jewish communities and organizations.

As the largest asset management company globally, BlackRock plays a pivotal role in shaping modern financial markets. However, with great influence comes scrutiny, and the company has not been immune to conspiracy theories or misinformation. One such narrative revolves around its supposed "Jewish connections." This article will delve into this topic, separating fact from fiction and offering a balanced perspective.

Our goal is to provide readers with accurate, well-researched information that adheres to journalistic integrity and ethical standards. By the end of this article, you'll have a clearer understanding of BlackRock's operations, its leadership structure, and the truth behind the claims linking it to Jewish communities.

Read also:2016 Olympics Allaround Gymnastics A Comprehensive Look At The Greatest Moments And Athletes

Table of Contents

- The History of BlackRock

- BlackRock's Leadership Profile

- Exploring BlackRock's Jewish Connections

- Debunking Common Myths

- Key Statistics About BlackRock

- BlackRock's Global Influence

- Ethical Concerns and Criticisms

- The Future of BlackRock

- Conclusion

- References

The History of BlackRock

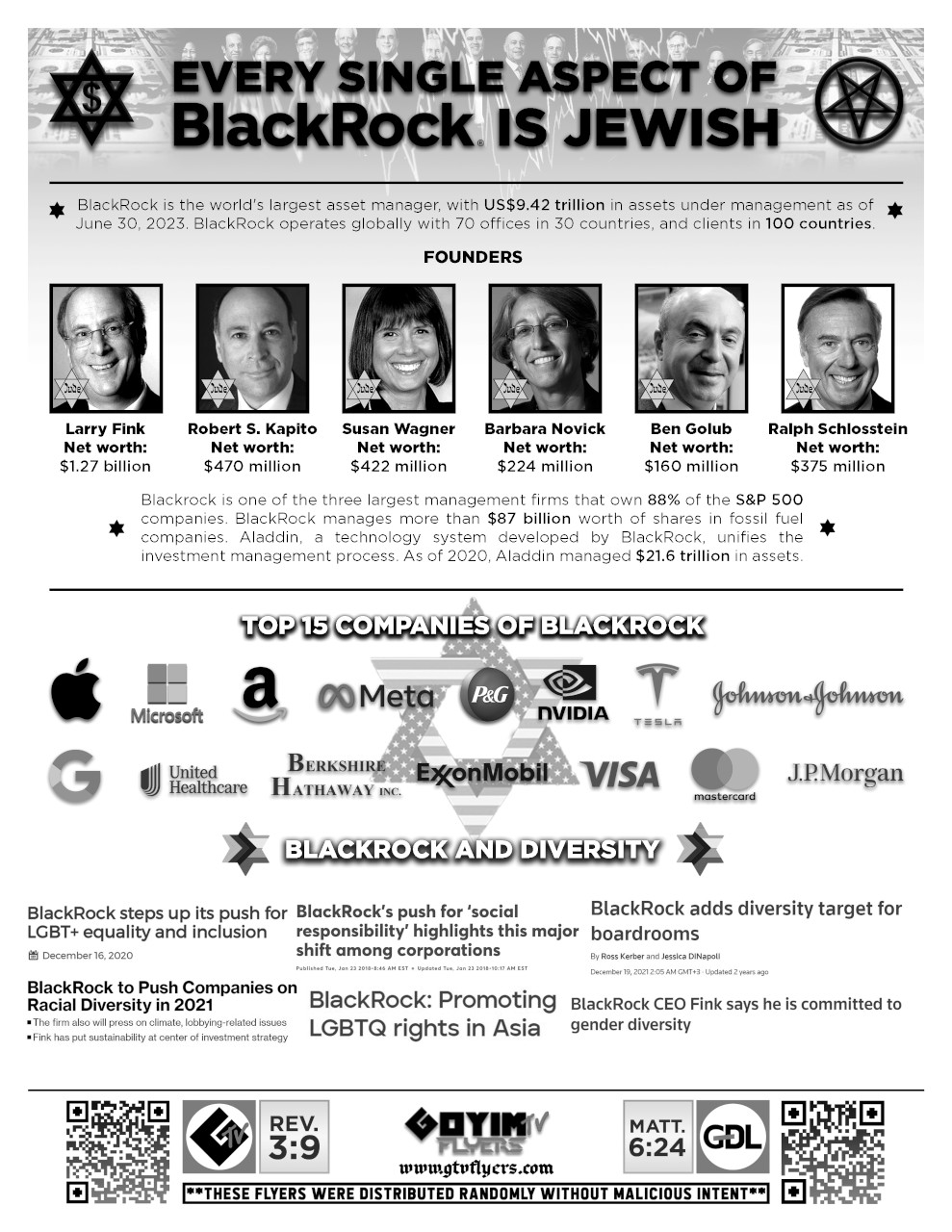

Founded in 1988 by Laurence D. Fink, BlackRock began as a small risk management advisory firm. Over the years, it has grown into a behemoth in the financial industry, managing trillions of dollars in assets. The company's journey is a testament to its innovative approach to investment management and its commitment to delivering value to clients.

Key Milestones in BlackRock's Growth

- 1988: BlackRock is established in New York City.

- 1999: BlackRock goes public, listing its shares on the New York Stock Exchange.

- 2009: The acquisition of Barclays Global Investors significantly boosts BlackRock's asset management capabilities.

- 2023: BlackRock continues to expand its footprint, focusing on sustainable investing and technological innovation.

Throughout its history, BlackRock has demonstrated a commitment to excellence, adapting to changing market conditions while maintaining its core values of integrity and client focus.

BlackRock's Leadership Profile

At the helm of BlackRock is Laurence D. Fink, the company's founder and CEO. Under his leadership, BlackRock has become a global leader in asset management. Fink's vision and strategic acumen have been instrumental in the company's success.

Biography of Laurence D. Fink

| Full Name | Laurence Douglas Fink |

|---|---|

| Date of Birth | November 6, 1952 |

| Place of Birth | Baltimore, Maryland, USA |

| Education | B.A. in Political Science from UCLA; M.B.A. from Harvard Business School |

| Professional Achievements | Founder and CEO of BlackRock; recipient of numerous awards for leadership in finance |

Fink's leadership style emphasizes transparency, accountability, and a long-term perspective. His commitment to these principles has earned him respect within the financial community and beyond.

Exploring BlackRock's Jewish Connections

One of the most debated topics surrounding BlackRock is its alleged ties to Jewish communities and organizations. While it is true that some of BlackRock's leaders and employees are of Jewish descent, this fact alone does not imply any special relationship between the company and Jewish interests.

Understanding the Narrative

The perception of BlackRock's "Jewish connections" stems from several factors:

Read also:Did Linda Purl Have Any Children Unveiling The Life And Legacy Of The Renowned Actress

- A significant number of prominent Jewish figures in the financial industry.

- The historical presence of Jewish professionals in Wall Street firms.

- Misinterpretation of corporate affiliations and charitable contributions.

It is essential to recognize that BlackRock operates as a global entity, serving clients from diverse backgrounds and cultures. Its business practices are driven by market demands and client needs, not by any specific ethnic or religious agenda.

Debunking Common Myths

Several misconceptions about BlackRock and its alleged "Jewish connections" have gained traction online. Let's examine these myths and separate fact from fiction.

Myth 1: BlackRock Controls Global Finance for Jewish Interests

This claim is unfounded and lacks evidence. BlackRock is a publicly traded company governed by a board of directors and subject to regulatory oversight. Its primary goal is to maximize returns for its shareholders and clients, regardless of their backgrounds.

Myth 2: BlackRock Donates Heavily to Jewish Causes

While BlackRock does engage in corporate philanthropy, its donations are distributed across various causes and communities. The company's charitable initiatives reflect its commitment to social responsibility and community engagement, not any specific religious or ethnic agenda.

Key Statistics About BlackRock

To provide context, here are some key statistics about BlackRock:

- Total assets under management: Over $10 trillion (as of 2023).

- Number of employees: Approximately 18,000 worldwide.

- Geographic reach: Operations in over 30 countries across six continents.

- Client base: Includes institutional investors, governments, corporations, and individual investors.

These figures underscore BlackRock's immense influence in global finance, but they also highlight its diverse and inclusive nature.

BlackRock's Global Influence

As the world's largest asset manager, BlackRock wields significant power in shaping financial markets. Its investment strategies and policies have far-reaching implications for economies and societies worldwide.

BlackRock's Role in Sustainable Investing

In recent years, BlackRock has prioritized sustainable investing, recognizing the importance of environmental, social, and governance (ESG) factors in long-term value creation. This shift reflects a broader trend in the financial industry toward responsible investing practices.

Ethical Concerns and Criticisms

Despite its achievements, BlackRock has faced criticism for various ethical concerns. Some critics argue that the company's size and influence pose risks to market stability and competition. Others question its commitment to ESG principles, citing inconsistencies in its investment practices.

Addressing Criticisms

BlackRock acknowledges these concerns and strives to address them through transparent communication and proactive measures. The company regularly engages with stakeholders to gather feedback and improve its operations.

The Future of BlackRock

Looking ahead, BlackRock is poised to continue its growth trajectory, driven by technological innovation and a focus on sustainable investing. The company's commitment to delivering value to clients while promoting responsible business practices positions it well for the future.

Key Focus Areas

- Expanding its digital capabilities to enhance client experience.

- Deepening its commitment to ESG investing and climate action.

- Strengthening its presence in emerging markets.

As BlackRock evolves, it will likely face new challenges and opportunities, requiring adaptability and resilience.

Conclusion

In conclusion, BlackRock is a global financial powerhouse with a rich history and a commitment to excellence. While claims of its "Jewish connections" have sparked debate, it is crucial to approach such narratives critically and with an open mind. BlackRock's operations are guided by market demands and client needs, not by any specific ethnic or religious agenda.

We encourage readers to engage with this article by sharing their thoughts and insights in the comments section. Additionally, consider exploring other articles on our site for more in-depth analyses of financial topics.

References

- BlackRock Annual Report 2022

- Forbes: "Laurence Fink's Leadership at BlackRock"

- Harvard Business Review: "The Role of Asset Managers in Sustainable Investing"

- Statista: "BlackRock Global Market Statistics"